Bonus paycheck calculator

A bonus paycheck tax calculator can help you find the right withholding amount for both federal and state taxes. - double time pay rate 40 and a one time bonus of 100 will result in these values.

How Bonuses Are Taxed Calculator The Turbotax Blog

The calculator on this page is focused on normal pay runs for hourly employees and their salaried counterparts but there are also a number of special situations when paychecks need a little more finagling.

. The salary paycheck calculator can help you estimate FLSA-exempt salaried employees net pay. Computes federal and state tax withholding for paychecks. This bonus tax aggregate calculator uses your last paycheck amount to apply the correct withholding rates to special wage payments such as bonuses.

The FREE Online Payroll Calculator is a simple flexible and convenient tool for computing payroll taxes and printing pay stubs or paychecks. The Viventium Bonus Calculator uses your last paycheck amount to apply the correct withholding rates to special wage payments such as bonuses. This hourly paycheck calculator helps you figure out the total gross pay or the weekly daily monthly or annual paycheck by considering hours worked pay rates.

The Oregon bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding. That means you shouldve had an extra 119 in every paycheck last year. The percentage method and the aggregate method.

The bonus tax calculator is state-by-state compliant for those states that allow the percent method of calculating withholding on special wage paychecks. But out in the real world dividing up your paycheck into spending and saving requires some additional calculating and a bit of shuffling. The calculator will also provide your FIRE age which is the age when you can expect to achieve FIRE and be able to retire.

The bonus tax calculator is state-by-state compliant for those states that allow the percent method of calculating withholding on special wage paychecks. The Illinois bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding. If you get confused when completing your W-4 the IRS provides a free withholding calculator to help you determine the amount of money that should be taken out of your paycheck for income tax.

The easiest way to achieve a salary increase may be to simply ask for a raise promotion or bonus. Feel free to run different scenarios through the calculator. The statutory bonus is calculated for all the months in a financial year and the total amount is paid to the employee either as a one-time earning or as monthly payments.

When an employee departs for example you may need to issue a final paycheck. Your average tax rate is 165 and your marginal tax rate is 297This marginal tax rate means that your immediate additional income will be taxed at this rate. While you wont find a magic formula that sets out hard-and-fast rules for divvying up income financial planners offer several.

Think of what you could do with 238 or more each month. Use the New Jersey bonus tax calculator to determine how much tax will be withheld from your bonus payment using the aggregate method. Exempt means the employee does not receive overtime pay.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. This New Jersey bonus pay aggregate calculator uses your last paycheck amount to determine and apply the correct withholding rates to special wage payments such as bonuses. If your employer tacks on your bonus to your regular paycheck the IRS will use this method which references the withholding tables to determine how much to take out of your wages.

The end result of requesting. However this is assuming. Rather than using a flat tax rate the bonus is added to regular wages to determine the additional taxes due.

Payments for non-deductible moving expenses often called a relocation bonus severance and pay for accumulated sick leave. In 2022 Cousins will earn a base salary of 5000000 a signing bonus of 25000000 and a roster bonus of 10000000 while carrying a cap hit of. If you make 55000 a year living in the region of Florida USA you will be taxed 9076That means that your net pay will be 45925 per year or 3827 per month.

Then enter the employees gross salary amount. Another option to increase the size of your Ohio paycheck is to seek supplemental wages such as commissions overtime bonus pay etc. It can also be used to help fill steps 3 and 4 of a W-4 form.

In California these supplemental wages are. The California bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding. The tax withholding rate on supplemental wages is a flat 35.

Kirk Cousins signed a 1 year 35000000 contract with the Minnesota Vikings including a 25000000 signing bonus 35000000 guaranteed and an average annual salary of 35000000. There is no head of household status for withholding formulas. LibriVox is a hope an experiment and a question.

Can the net harness a bunch of volunteers to help bring books in the public domain to life through podcasting. Managing finances looked so easy in grade school with those cute pie charts sliced into brightly colored wedges. By using our FREE bonus check calculator you can find out how much your company bonus will net after taxes.

Other useful paycheck calculators. If youre unsure how much to write in use the paycheck calculator to get an idea of what your tax liability is. You may find youll need to contribute more money to your investment and retirement accounts or experiment with different rates of return to meet your goals.

Aggregate method There are two ways to calculate taxes on bonuses. Your marital status determines which formula your employer will use to calculate the tax to be withheld from your paycheckThis is because the tax rates and standard deduction amounts are different depending on whether you are married or single. Flexible hourly monthly or annual pay rates bonus or other earning items.

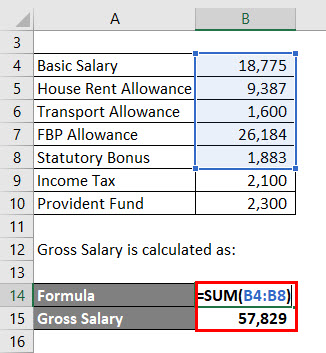

Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. What does eSmart Paychecks FREE Payroll Calculator do. For this employees salary level the minimum statutory bonus for a month is 7000 833100 583 The maximum statutory bonus for a month is 7000 20100 1400.

Get the latest financial news headlines and analysis from CBS MoneyWatch. This is state-by state compliant for those states that allow the aggregate method or percent method of bonus calculations. To try it out enter the employees name and location into our free online payroll calculator and select the salary pay type option.

Learn the two tax methods used on bonus checks. This calculator uses the Aggregate Method. And if you went through a major life change over the past year that might impact how much you owe in taxesyou got married bought a house or welcomed a baby into the worldits a good idea to take a fresh.

The bonus tax calculator is state-by-state compliant for those states that allow the percent method of calculating withholding on special wage paychecks.

Salary Formula Calculate Salary Calculator Excel Template

Bonus Calculator Percentage Method Primepay

How Bonuses Are Taxed Calculator The Turbotax Blog

Employee Bonuses How To Calculate For 3 Types Of Bonus Pay Indeed Com

Bonus Tax Rate 2022 How Bonuses Are Taxed And Who Pays Nerdwallet

What Is The Bonus Tax Rate For 2022 Hourly Inc

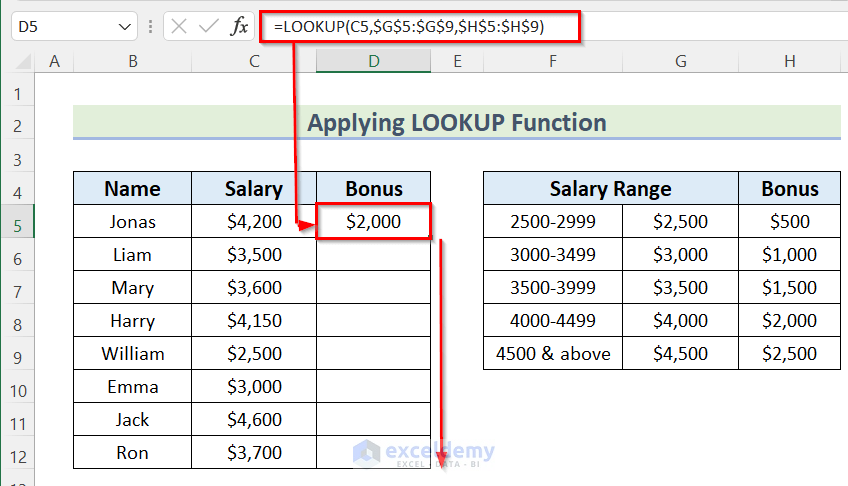

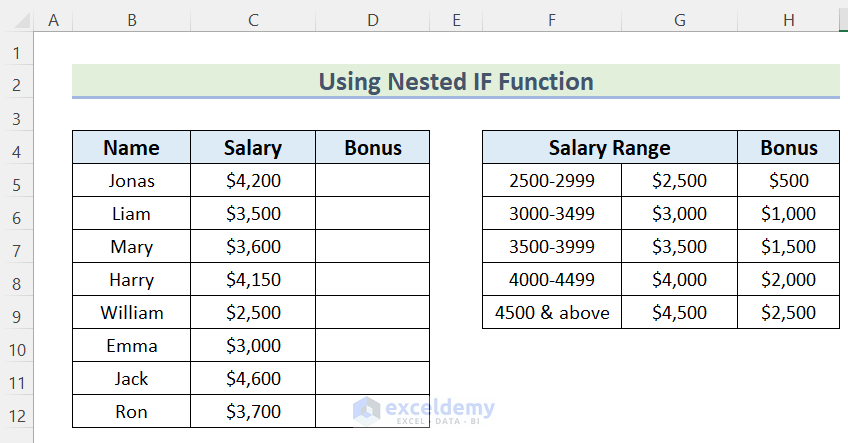

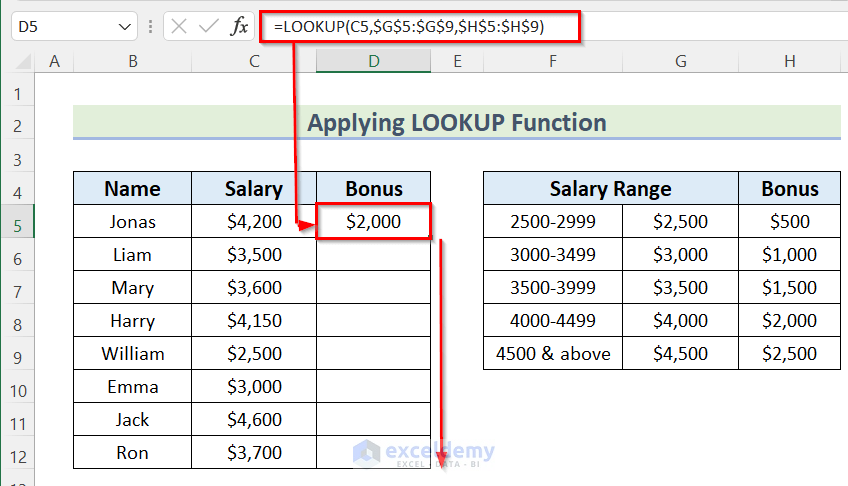

How To Calculate Bonus On Salary In Excel 7 Suitable Methods

How Do You Calculate A Prorated Bonus Zippia

Bonus Calculator Bonus Pay Tax Calculator Tool From Viventium

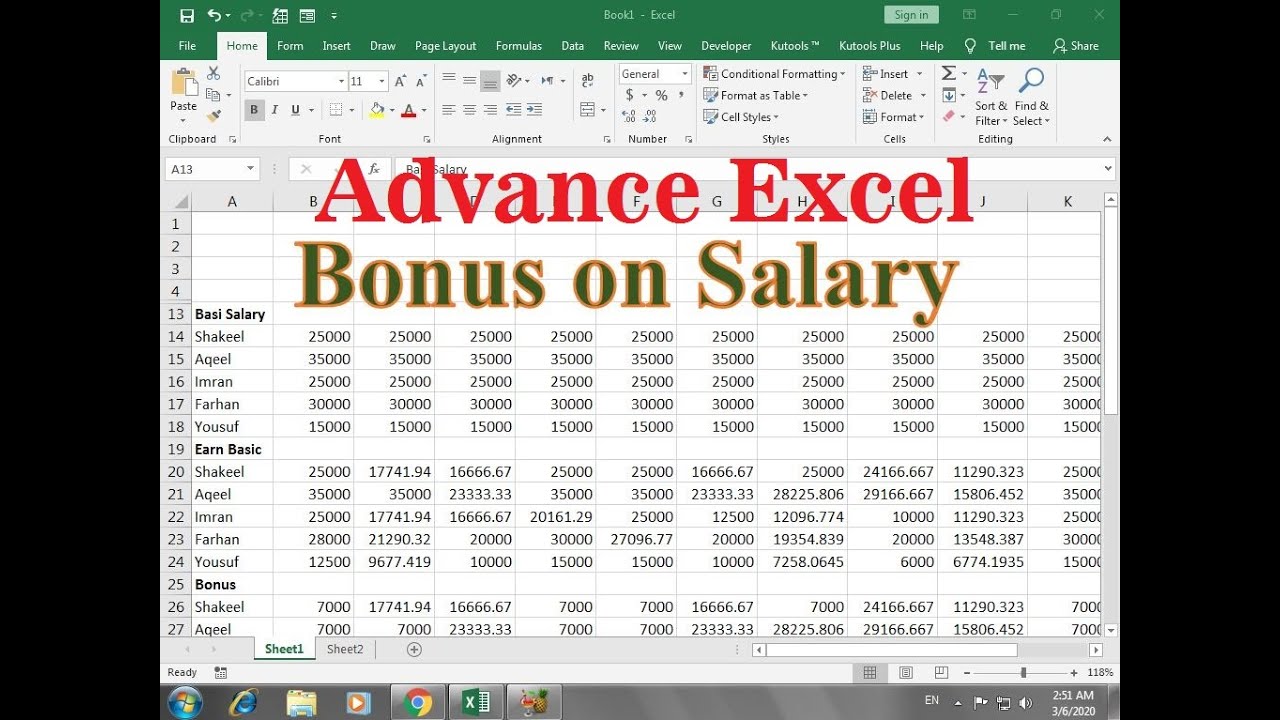

How To Calculate Bonus On Salary In Excel Youtube

Avanti Bonus Calculator

Avanti Bonus Calculator

How To Calculate Bonuses For Employees

Salary Formula Calculate Salary Calculator Excel Template

Calculate Bonus In Excel Using If Function Youtube

4 Ways To Calculate Annual Salary Wikihow

How To Calculate Bonus On Salary In Excel 7 Suitable Methods